Ipo Underwriting Process : About Ipos / When the size of issuance is large, there exists a lead investor followed by a group of underwriters working under him and together with him.

Ipo Underwriting Process : About Ipos / When the size of issuance is large, there exists a lead investor followed by a group of underwriters working under him and together with him.. The most common type of underwriting agreement is a firm commitment in which the underwriter agrees to assume the risk of buying the entire inventory of stock issued in the ipo and sell to the. The investment bank (bookrunner or lead underwriter) you select to take your company through the ipo process can play a large role in the success of your offering. The prospectus contains much of the same information contained in. This is also known as going public. beyond structuring a firm's shares for sale, the process. When the size of issuance is large, there exists a lead investor followed by a group of underwriters working under him and together with him.

Submitting form a1 the underwriter assists the company in submitting preliminary application documents for listing to the listing department of the stock exchange. Find detailed data on 42,000+ initial public offerings. In the dutch auction process for an ipo, the underwriter does not set a fixed price for the shares to be sold. An ipo is the process by which a private company issues its first shares of stock for public sale. An initial public offering (ipo) involves a previously privately held company selling shares on the open market for the first time.

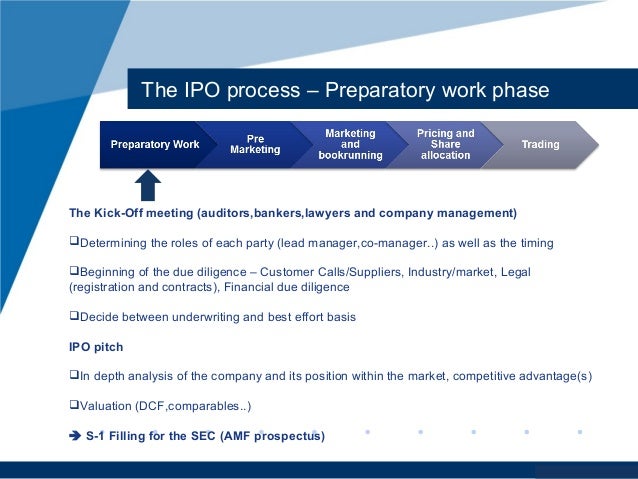

The underwriting process the underwriting process begins whith the decision of what type of offering the company needs.

In the dutch auction process for an ipo, the underwriter does not set a fixed price for the shares to be sold. An initial public offering (ipo) refers to the registration and sale of stocks of a private firm or company to the gene. An ipo is underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.through this process, colloquially known as floating, or going public. While smaller or individual investors are finding it easier to buy ipo shares through online brokerage firms, they may still find it difficult to buy ipo shares for a number of reasons: Ipo underwriting process the underwriter is usually an investment bank that employs ipo specialists. For all intents and purposes, an underwriter is the bank or financial institution that distributes the shares of a newly public company, effectively serving as a middleman between the company and the investing public. Historically, an initial public offering, or ipo, has. They have wide latitude in allocating ipo shares. When an investment bank, like goldman sachs or morgan stanley is eventually hired, the company and the investment bank talk. Thus the number of underwriters in the ipo process would depend on the size of the public issue. Ipo underwriting agreement means that certain underwriting agreement dated as of september 24, 2014 among the ipo underwriters, cone gathering, the general partner and the partnership, providing for the purchase of common units by the ipo underwriters. An ipo often involves more than one underwriter, with one lead underwriter in the most prominent role. In addition to reading the prospectus, be sure to ask questions if the information

The process of issuing and. Initial public offering (ipo) or stock market launch is a type of public offering in which shares of a company are sold to institutional investors and usually also retail (individual) investors. The prospectus contains much of the same information contained in. The underwriters and the company that issues the shares control the ipo process. Ipo underwriting agreement means that certain underwriting agreement dated as of september 24, 2014 among the ipo underwriters, cone gathering, the general partner and the partnership, providing for the purchase of common units by the ipo underwriters.

This is also known as going public. beyond structuring a firm's shares for sale, the process.

Access deal multiples, deal size, valuations, exiting investors, stock info and advisors. In addition to reading the prospectus, be sure to ask questions if the information The investment bank is selected according to the following criteria: In this instance, you will be able to. Underwriting and valuation the ipo process consists of determining the value of a company, creating public shares, and raising money by selling those shares to investors. The most common type of underwriting agreement is a firm commitment in which the underwriter agrees to assume the risk of buying the entire inventory of stock issued in the ipo and sell to the. The first step of the ipo process requires the company to select an investment bank. As part of this process, the issuer or underwriter must provide all offerees or prospective purchasers with a disclosure document, known as a prospectus. An ipo often involves more than one underwriter, with one lead underwriter in the most prominent role. Once selected, the company and its investment bank write the underwriting agreement. Ipo underwriters are specialists who work alongside the company issuing the ipo. The sec does not regulate the business decision of how ipo shares are allocated. They have wide latitude in allocating ipo shares.

Thus the number of underwriters in the ipo process would depend on the size of the public issue. An initial public offering (ipo) refers to the registration and sale of stocks of a private firm or company to the gene. See what you can research. Find detailed data on 42,000+ initial public offerings. Ipo underwriting process the underwriter is usually an investment bank that employs ipo specialists.

Historically, an initial public offering, or ipo, has.

For all intents and purposes, an underwriter is the bank or financial institution that distributes the shares of a newly public company, effectively serving as a middleman between the company and the investing public. The first step in the ipo process is for the issuing company to choose an investment bank to advise the company on its ipo and to provide underwriting services. An ipo is underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges.through this process, colloquially known as floating, or going public. An initial public offering (ipo) refers to the registration and sale of stocks of a private firm or company to the gene. While smaller or individual investors are finding it easier to buy ipo shares through online brokerage firms, they may still find it difficult to buy ipo shares for a number of reasons: This is also known as going public. beyond structuring a firm's shares for sale, the process. But the process gets tricky when multiple underwriters — or bookrunners — are involved. From many of the players in the ipo market, including investment bankers, venture capitalists and emerging growth companies, especially those in the technology and life sciences industries. An ipo often involves more than one underwriter, with one lead underwriter in the most prominent role. Historically, an initial public offering, or ipo, has. Ipo underwriters are specialists who work alongside the company issuing the ipo. The process of issuing and. When an investment bank, like goldman sachs or morgan stanley is eventually hired, the company and the investment bank talk.

Komentar

Posting Komentar